Picture logging into your bank in February 2026 and spotting a $2000 direct deposit February 2026 from the IRS—unexpected relief amid rising costs and tax season hustle. Viral claims and blogs promise automatic one-time payments, often linking them to tariff dividends or new relief programs. As of mid-February 2026, official IRS statements, news fact-checks, and government sources confirm no new nationwide $2000 direct deposit or stimulus exists this month. No congressional approval, no Treasury rollout, and no IRS announcement supports these rumors. Many confuse regular tax refunds (which can hit around $2000 for some) with “stimulus.” This guide explains the claims, debunks myths, and highlights real February money like refunds and benefits.

What the $2000 February Direct Deposit Claim Really Means

Rumors recycle old stimulus ideas, now tied to President Trump’s tariff dividend proposal—$2000 checks from tariff revenue for middle- and lower-income folks. Despite promises of 2026 issuance, no formal bill passed, no Supreme Court ruling cleared it, and timelines shifted later or remain uncertain. Clickbait sites exaggerate “IRS confirmation” without proof. Reliable outlets like FOX, Economic Times, and Asbury Park Press label it unfounded—no new federal payment program launched.

Who Qualifies for Actual February Funds

No universal $2000 eligibility applies. Real IRS money flows from tax refunds, credits, or ongoing benefits—not fresh stimulus. U.S. citizens/residents with SSN/ITIN and updated filings access verified amounts.

Typical Income Thresholds for Refunds/Credits

| Filing Status | Common Full Threshold |

|---|---|

| Single | $75000 |

| Married Filing Jointly | $150000 |

| Head of Household | $112500 |

Groups Seeing Deposits

Early 2026 tax filers (refunds via direct deposit in 21 days). Social Security/SSI/SSDI (monthly). VA benefits (standard schedule). No new $2000 targets these groups.

Real Payment Timeline in February 2026

No $2000 direct deposit February 2026 rollout. Track genuine ones:

Tax refunds: 21 days post-e-file (mid-February for early January filers). SSI/Social Security: Monthly waves. VA: Standard monthly. Executive Order updates: Paper checks phased out since late 2025—direct deposit prioritized.

Use IRS “Where’s My Refund?” for status.

Steps to Get or Verify Your Money

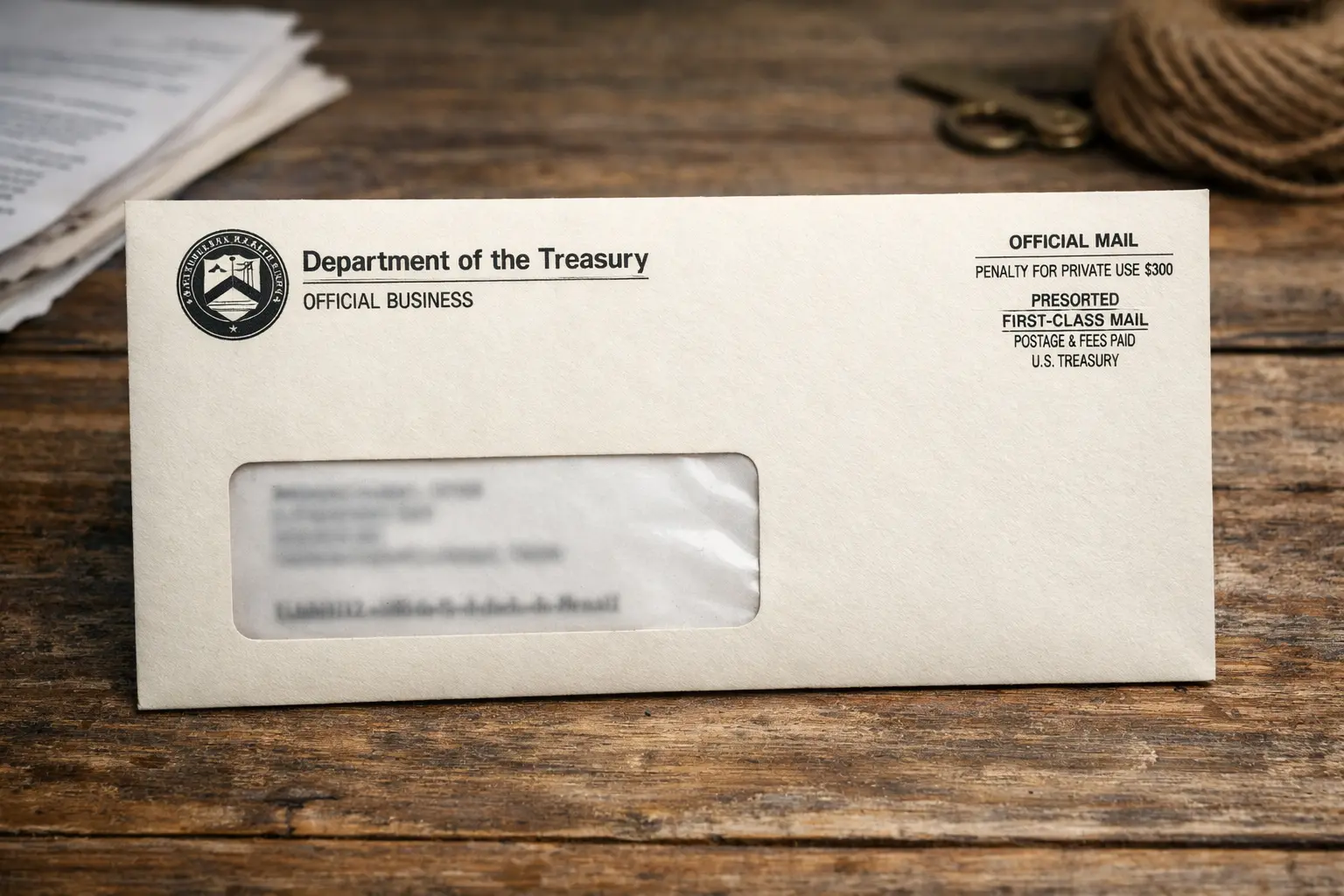

File/amend 2025 taxes electronically with direct deposit info. Update banking on IRS.gov. Track refunds via official tools. Ignore unsolicited texts/calls promising $2000—IRS mails only.

Why Rumors Persist in February

Tax season + economic pressures fuel hope. Social media mixes proposals with routine refunds. Scammers exploit with fake “claim now” links. Real refunds (often $1000–$2000+) get mislabeled as stimulus.

FAQs – $2000 IRS Direct Deposit February 2026

- Is a $2000 direct deposit February 2026 confirmed? No—IRS and official sources deny new stimulus or tariff payment.

- What’s the latest on Trump’s $2000 tariff dividend? Proposal only—no law or February rollout; uncertain timeline.

- Who gets real IRS money this month? Early filers via refunds; benefit recipients on schedule.

- How do I track refunds or payments? IRS.gov “Where’s My Refund?” or SSA/VA portals.

- Can refunds reach $2000? Yes—for some via withholdings/credits—but not automatic stimulus.

Conclusion

February 2026 brings no IRS-approved $2000 direct deposit—it’s ongoing rumor without evidence. Rely on IRS.gov for real refunds, benefits, and updates. File taxes promptly, secure your info, and avoid scams. Focus on verified funds to make the most of tax season.