Picture opening your bank app in mid-February 2026 and seeing an unexpected $2000 direct deposit February 2026 from the IRS—no strings attached. Viral posts and blogs promise this exact relief for families battling high costs, often linking it to tariff dividends or new stimulus. As tax season ramps up, these claims spread fast. The hard truth from official sources? The IRS has not confirmed or approved any new $2000 nationwide payment for February 2026. No law authorizes it, and the agency warns against scams. This guide explains the buzz, debunks myths, and shows real money flowing this month—like tax refunds and benefits.

What the $2000 February Claim Is About

Rumors recycle pandemic-era stimulus talk, now tied to President Trump’s tariff dividend proposal. He floated $2000 checks from tariff revenue for middle- and lower-income folks, but no bill passed Congress. No Supreme Court ruling or IRS announcement backs payments in February. Clickbait sites exaggerate or fabricate “confirmation”—stick to IRS.gov for facts.

Who Might Qualify for Real February Money

No universal $2000 eligibility exists. Real funds come from tax refunds, credits, or ongoing benefits—not a new stimulus. U.S. citizens/residents with SSN/ITIN and recent filings lead. Income limits apply to credits; benefit recipients auto-see deposits.

Typical Income Thresholds for Credits/Refunds

| Filing Status | Common Full Credit Threshold |

|---|---|

| Single | $75000 |

| Married Filing Jointly | $150000 |

| Head of Household | $112500 |

Groups Receiving Deposits Now

Social Security/SSI/SSDI (monthly schedule). VA benefits (early or end-of-month). Early 2026 tax filers with refunds (direct deposit in 21 days). No new $2000 federal relief program targets these groups.

Real Payment Timeline in February 2026

No $2000 direct deposit February 2026 rollout. Track verified ones:

Tax refunds: Within 21 days of e-filing (earliest mid-February for January filers). SSI: February payments already processed (early shift). Social Security: By birth date waves. VA: Standard monthly. EITC/ACTC refunds: Mostly by early March for direct deposit filers.

Direct deposit remains fastest; paper phased out per executive order.

Steps to Secure Any Owed Money This Month

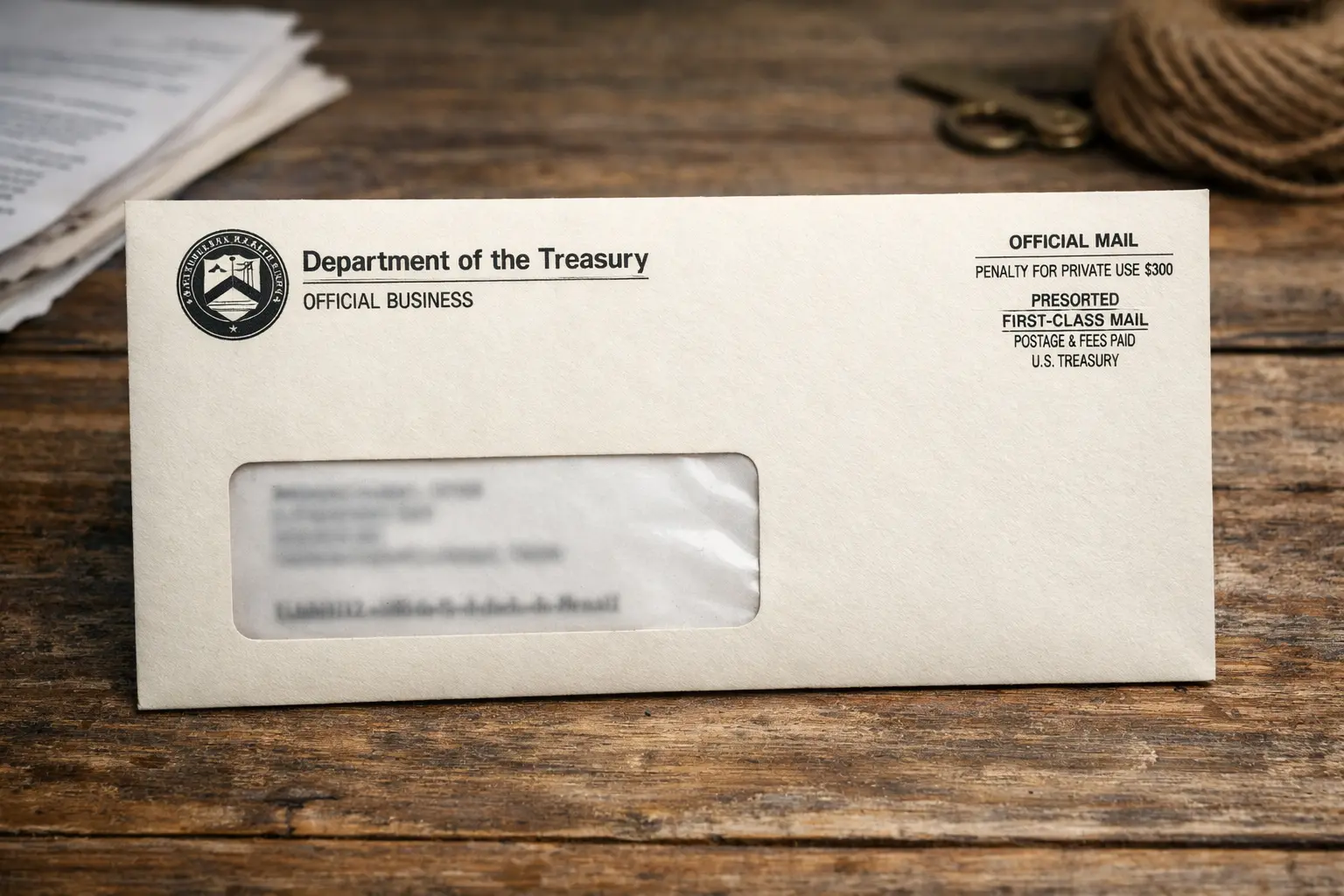

File 2025 taxes electronically with direct deposit info for quick refunds. Update banking/details on IRS.gov to avoid freezes. Use “Where’s My Refund?” tool for status. Ignore unsolicited calls/texts claiming $2000—IRS mails only.

Why Rumors Keep Circulating in February

Tax season stress + holiday aftermath fuels hope for extras. Social media amplifies unverified posts. Scammers prey on confusion with fake claim links. Real refunds (often $1000–$2000+) get mistaken for “stimulus.”

FAQs – $2000 IRS Direct Deposit February 2026

- Is there a confirmed $2000 direct deposit February 2026? No—the IRS and official sources confirm no new stimulus or tariff payment.

- What about Trump’s $2000 tariff dividend? Still a proposal—no law, no IRS rollout in February 2026.

- Who gets real money from IRS this month? Early filers via refunds; benefit recipients on schedule.

- How do I check for my refund or payment? IRS.gov “Where’s My Refund?” or your benefit portal.

- Could refunds or stacks reach $2000? Yes—for some via withholdings, credits, and EITC—but not automatic stimulus.

Conclusion

In February 2026, no IRS-approved $2000 direct deposit arrives—it’s persistent rumor without backing. Focus on filing accurately, updating info, and tracking real refunds or benefits. Official IRS channels only for guidance. Act now to claim what’s truly yours and skip the scam traps.